Choosing a career in finance can be challenging. Investment banking, private equity, and venture capital are top choices.

Each path offers unique opportunities and challenges. Investment banking involves advising companies on major transactions. Private equity focuses on investing in private companies to improve their value. Venture capital funds new startups with high growth potential. Understanding these roles can guide your career choice.

In this blog post, we will explore the differences between these finance careers. We’ll look at the daily tasks, required skills, and potential rewards. By the end, you will have a clearer picture of which path suits you best. Let’s dive into the world of finance and discover the right fit for you!

Credit: www.instagram.com

Introduction To Finance Careers

Investment Banking, Private Equity, and Venture Capital are three finance fields. Each has its own unique roles and responsibilities. Investment bankers help companies raise money. They also advise on mergers and acquisitions. Private equity professionals buy and manage companies. They aim to improve and sell them for a profit. Venture capitalists invest in startups. They look for high-growth potential.

Choosing the right finance career is crucial. It affects your daily tasks and career growth. Investment banking suits those who enjoy fast-paced environments. Private equity is for those who like fixing and growing companies. Venture capital fits those who want to support new ideas. Think about your interests and strengths. This helps in making the right choice.

Credit: www.instagram.com

Investment Banking

Investment banking helps companies raise money. They advise on mergers and acquisitions. They also help with initial public offerings (IPOs). These bankers analyze markets and create financial models. They work long hours and handle high pressure tasks.

Strong analytical skills are crucial. Good communication is key. They need to understand financial statements. Attention to detail is important. They must be good at problem-solving. Time management is essential due to long hours.

Entry-level positions start as analysts. After a few years, they can become associates. Moving up, they can reach vice president level. Further growth leads to managing director roles. Senior roles offer higher salaries and more responsibility.

Private Equity

Private Equity involves buying and restructuring companies to increase their value. It differs from Investment Banking, which focuses on financial services, and Venture Capital, which invests in startups. Understanding these distinctions helps in making informed career choices.

Role And Responsibilities

Private Equity professionals invest in private companies. They help these companies grow. They buy companies using funds. These funds come from investors. They work to improve the company’s value. They aim to sell the company later for a profit. They analyze financial reports. They create growth plans. They work closely with company leaders. They make key decisions. They look for ways to cut costs. They find new business opportunities.

Skills Required

Strong analytical skills are essential. A background in finance is helpful. Good communication skills matter. Teamwork is important. Understanding markets is key. Problem-solving skills are needed. Attention to detail is crucial. Leadership skills help. You must be good at decision-making.

Career Progression

Starting as an analyst is common. Promotion to associate follows. Senior associate is the next step. Then, you can become a vice president. After that, you may become a director. The highest role is managing director. Each step comes with more responsibility. Experience and skills are important for growth. Networking helps in career progression.

Venture Capital

Venture capitalists give money to new companies. They look for startups with great potential. They help these companies grow. They also guide and advise these companies. Their role is to ensure the company succeeds. They expect a high return on their investment.

Strong analytical skills are needed. Good communication is essential. Ability to work under pressure is a must. One must be good at networking. Understanding of market trends is crucial. Technical knowledge can be helpful.

Starting as an analyst is common. One can move up to an associate. Then, you may become a principal. The next step is to be a partner. Finally, one can be a managing partner. The path is long but rewarding.

Comparing Investment Banking, Private Equity, And Venture Capital

Investment banking jobs are fast-paced and often stressful. People work long hours. Private equity jobs are also demanding but can be less chaotic. Venture capital jobs are more relaxed. These jobs involve working with startups and new businesses.

Investment bankers usually earn the most. They get high salaries and bonuses. Private equity professionals also earn well, especially with successful deals. Venture capitalists make money through equity in startups. Their earnings can vary.

Investment bankers often have poor work-life balance. They work many hours and weekends. Private equity professionals have a better balance. They work hard but get more personal time. Venture capitalists have the best balance. Their work is flexible.

Education And Qualifications

A bachelor’s degree in finance or business is a must. An MBA is often required. Many also get CFA or CPA certifications. These show you have deep knowledge. They also show you can handle complex tasks.

Experience in financial analysis is vital. Work in investment banking or consulting is helpful. Internships during school can give you a head start. Hands-on projects also count.

Attend industry events and conferences. Join finance clubs at school. Connect with alumni working in finance. Use LinkedIn to find and connect with professionals. Always be polite and respectful. Follow up after meetings.

Pros And Cons Of Each Career Path

Investment Banking offers high salaries and bonuses. You can work on big deals and learn a lot. But the hours are long. Stress levels are high. There is little work-life balance. The job can be very demanding. You may have little time for personal life.

Private Equity can be lucrative. You can make big investment decisions. It offers high salaries. You get to work with companies long-term. But jobs are competitive. Hours can be long. You need many years of experience. It can be hard to enter this field.

Venture Capital is exciting. You work with startups. You can make a big impact. The job offers good pay. You get to see new ideas. But it is risky. Many startups fail. The work can be unstable. It can be hard to find good deals. Experience is important.

Making The Right Career Choice

Decide what you enjoy doing. Investment banking involves analyzing financial data. Private equity focuses on improving company performance. Venture capital deals with helping startups grow. Think about which tasks excite you more. Your passion will drive your success.

Consider your future aspirations. Investment banking offers high salaries but can be demanding. Private equity provides hands-on experience with companies. Venture capital allows you to shape new businesses. Choose the path that aligns with your long-term vision.

Stay updated on current trends. Investment banking is stable but competitive. Private equity is growing with many opportunities. Venture capital is booming with new startups. Understanding the market helps you make an informed decision.

Success Stories And Case Studies

Investment bankers help companies raise money. They work on big deals. Jamie Dimon is a famous investment banker. He is the CEO of JPMorgan Chase. Lloyd Blankfein led Goldman Sachs for many years. They both made big impacts in their fields.

Private equity professionals buy and improve businesses. Stephen Schwarzman is a leader in private equity. He co-founded Blackstone Group. Henry Kravis also made a name in this field. He co-founded KKR. Both have many success stories.

Venture capitalists invest in new companies. Peter Thiel is a well-known venture capitalist. He co-founded PayPal and invested in Facebook. Marc Andreessen is another famous name. He co-founded Andreessen Horowitz. They help many startups grow big.

Conclusion And Final Thoughts

Choosing between Investment Banking, Private Equity, and Venture Capital depends on your career goals and interests. Each field offers unique challenges and opportunities. Understanding their differences can help you make an informed decision.

Summary Of Key Points

Investment banking deals with large financial transactions. This includes mergers and acquisitions. Private equity firms invest in private companies. They aim to improve these companies and sell them later. Venture capital funds new startups. They look for high growth potential. Each field requires different skills. Investment banking needs strong analytical skills. Private equity values operational expertise. Venture capital needs good judgment of new ideas.

Encouragement For Aspiring Professionals

Start by learning the basics of finance. Read books and take courses. Gain experience through internships. Network with professionals in the field. Stay curious and keep learning. Each step brings you closer to your goal. Passion and perseverance are key. Keep pushing forward.

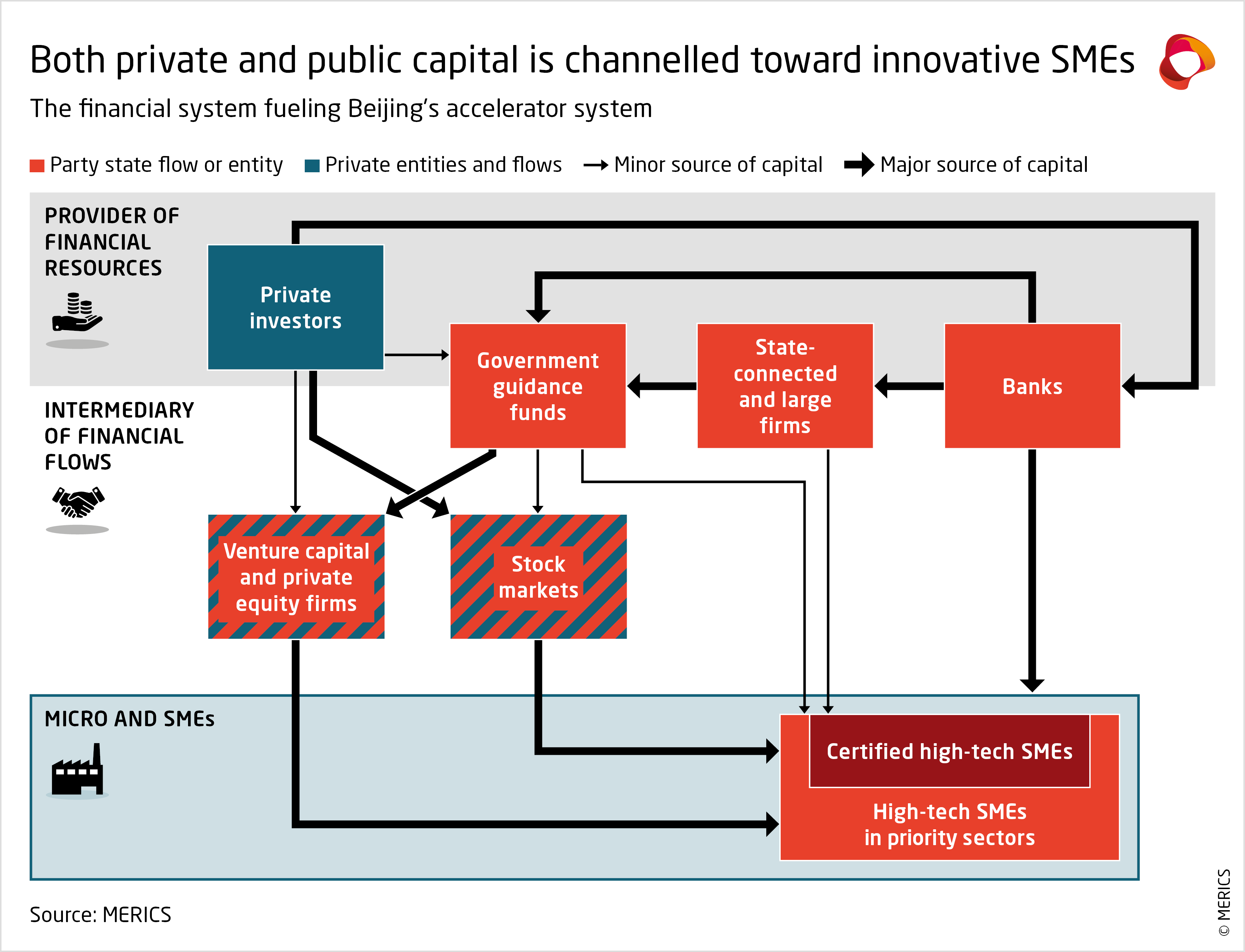

Credit: merics.org

Frequently Asked Questions

What Is The Role Of Investment Banking?

Investment banking focuses on raising capital for companies. It involves underwriting new debt and equity securities. It also provides advisory services for mergers and acquisitions.

How Does Private Equity Work?

Private equity involves investing in private companies. The goal is to restructure and improve them. These investments are usually long-term.

What Is Venture Capital?

Venture capital funds early-stage, high-potential startups. Investors provide capital in exchange for equity. It is high-risk but can offer high returns.

Which Is More Risky: Venture Capital Or Private Equity?

Venture capital is generally riskier. It invests in early-stage startups. Private equity targets more mature companies, thus typically involves lower risk.

Conclusion

Choosing between Investment Banking, Private Equity, and Venture Capital can be tough. Each offers unique opportunities and challenges. Investment Banking involves advising clients and raising capital. Private Equity focuses on buying and improving companies. Venture Capital invests in startups with high growth potential.

Think about your interests and career goals. Each path offers different rewards. Research thoroughly before making a decision. Your future success depends on the right choice. Good luck with your career journey.